Development Incentives

The City of Fort Worth, Tarrant County and other taxing jurisdictions are committed to quality, thoughtful center city growth. For meritorious development and redevelopment projects, there are certain incentives available. The descriptions below provide a summary and links to more information.

City of Fort Worth

City economic development efforts are focused on projects or opportunities that produce a meaningful impact on the City and its economy and result in one or more of the following:

- Growth of business activity, employment, or investment in one of the City's identified Target Industries

- Creation of high-wage jobs;

- Significant Capital investment;

- Growth of business activity, employment, or investment in the Central Business District;

- Revitalization with likelihood of ancillary development in a key employment node or specially designated area of the city;

- Retention or expansion of an existing major employer;

- Anchoring of a business expansion project with potential to generate additional supply chain activity.

Click here to view the City of Fort Worth Incentive Policy - 2019.

Tax Abatement Program

A tax abatement is the full or partial exemption from ad valorem taxes on eligible properties for a period of up to ten years and an amount of up to 100 percent of the increase in appraised value (as reflected on the certified tax roll of the appropriate county appraisal district) resulting from improvements begun after the execution of the tax abatement agreement.

Click here for more information about tax abatements offered by the City of Fort Worth.

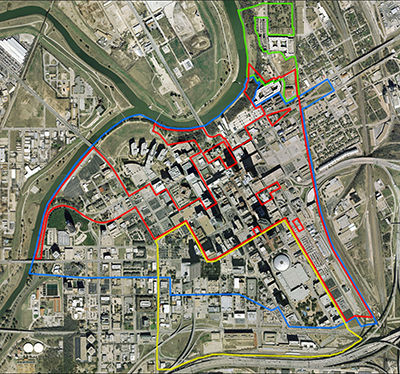

Tax Increment Finance District #3 and #8

A significant public-private partnership that adds to the success of Downtown is the Downtown Tax Increment Finance District (TIF) and the other Downtown-oriented TIFs. The Downtown TIF makes strategic investments in parking, infrastructure, historic preservation, and residential development. The TIF is a collaboration of the City of Fort Worth, Tarrant County, Tarrant County Hospital District, Tarrant County College District, and Tarrant Regional Water District.

To date, the TIF has obligated $94 million, leveraging $543 MILLION in private development and facilitating $41 million in public investment.

Chapter 380 Economic Development Program Grants

The purpose of these local grants is to reimburse private developers for the range of expenses that may contribute to a financing gap yielding projects financially infeasible. To this end, the city will also be sensitive to the taxable implications these grants may have for the developer and where possible, use transfer mechanisms (i.e., soft loans, accrual notes, etc.) which result in a favorable financial impact.

Click here for more information.

Click here for the City of Fort Worth Economic Development Program Policy for Grants Authorized by Chapter 380.

Brownfields Economic Redevelopment

Brownfield sites are properties where expansion, redevelopment, or reuse may be complicated by potential or known hazardous substances, pollutants or contaminants.

Click here for more information.

Texas Historic Preservation Tax Credit Program

The new state historic tax credit is worth 25 percent of eligible rehabilitation costs and is available for buildings listed in the National Register of Historic Places, as well as Recorded Texas Historic Landmarks and Texas State Antiquities Landmarks.

Click here for more information.

Texas Department of Housing and Community Affairs

The TDHCA Housing Tax Credit (HTC) Program is one of the primary means of directing private capital toward the development and preservation of affordable rental housing for low-income households.

Click here for more information.